Table Of Content

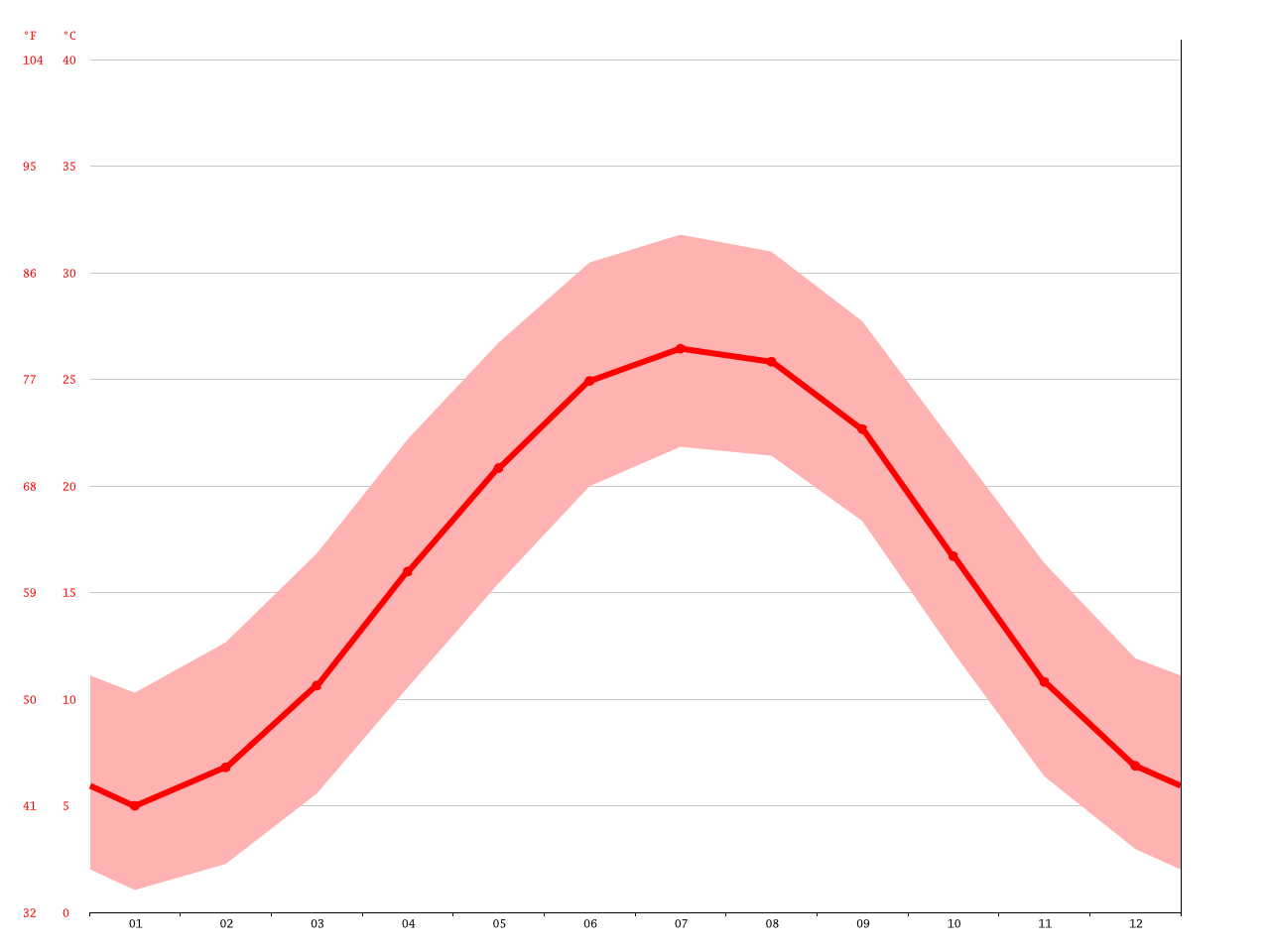

One weaker point for Charlotte’s housing market is its overall home appreciation rates over the last couple decades. In fact, NeighborhoodScout shows that from 2000 to 2022, Charlotte homes saw a 156.67% cumulative appreciation rate. While that might seem great, consider that nearby Asheville, North Carolina, saw a 225.34% appreciation rate over that same period of time.

I am nervous about moving, what is the typical cost of moving to another city and what should I have to think about?

We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. On the other hand, if you need to be location-flexible or don’t have enough funds built up yet for a down payment, renting is probably the better option. However, if buying a home is in your plan, use this time to save by taking on a roommate, renting a cheaper apartment or moving in with family. Also, open a dedicated savings account to earmark money for your down payment. So when deciding where to live, determine whether your income level will be able to keep pace with cost of living increases.

Rental Resources

This is where the 28/36 rule comes in, which clarifies how much how you can afford. The 28/36 rule is a common sense guideline that states you should not spend more than 28% of your monthly gross income on housing—either your mortgage payment or rent—and 36% of your monthly gross income on your total debt. Total debt includes your housing debt along with all other forms of debt, such as student loans and auto loans. As you shop for a home in different cities and towns, crunch the numbers using our cost of living calculator to see how your total cost of living expenses vary. Explore the cheapest places to live in America relative to income. Ranking of cost of living by city based on the consumer price index and access to affordable housing (housing-to-income rates) using data from the U.S.

Cost of living calculators

This is how much you need to afford a 2-bedroom apartment in Charlotte - WCNC.com

This is how much you need to afford a 2-bedroom apartment in Charlotte.

Posted: Thu, 27 Oct 2022 07:00:00 GMT [source]

Our cost of living index is calculated by using prices of goods in six categories – Housing, Groceries, Utilities, Health Care, Transportation, and Miscellaneous Goods & Services. Cities scoring less than 100 have lower cost of living than the national average. The cost of groceries is slightly below the average than in other cities at 99.2. You can expect to pay approximately $2.42 for a loaf of bread, $1.98 for a dozen eggs, and $3.01 for a gallon of milk.

Quality of Life

This makes Charlotte an incredibly affordable city, as housing is 14% cheaper on average than the rest of the country. NerdWallet, PayScale, and Best Places all give Charlotte favorable scores for housing. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. Like many places around the U.S., rental costs have gone up significantly during 2021.

Discretionary spending could also include luxury goods and travel. Discretionary spending is influenced not only by how much disposable income one has remaining after paying for essential expenses, but also by the overall economic climate. People generally feel more comfortable spending on non-essential items when broader economic conditions are positive. A cost of living comparison can estimate how far your salary will go based on location.

This information is important when job searching or when considering relocating or purchasing a home in a new part of the country, or even the world. The information provided by a cost of living index can help you get a realistic snapshot of living expenses and create a budget. This information can also help you determine whether or not you can afford to live in a particular location at all. It is the third-largest expense category for consumers, behind housing and transportation respectively.

Let’s take a quick look at some ways you can compare your current living cost with what you might experience if you move to Charlotte. Prices for goods and services in Charlotte are partly crowdsourced by our visitors, just like yourself. Charlotte is located in Mecklenburg County, which has a 7.25% sales tax. Additionally, the average effective property tax rate in Mecklenburg County is 1.05%.

Check your current city’s livability score

These tools, which are typically free, provide a comparison based on income and regional costs for housing, transportation, food, healthcare, and other basic necessities in the two locations you select. Total monthly expenditure you can expect to incur depends on the cost of housing, food, utilities, transportation, healthcare, other miscellaneous goods and services. Note that your household composition (single or married, number of kids) and home ownership status (renting vs. owning) might affect your monthly expenses.

This means your commute might be shorter if you move to Charlotte from another state. All information is provided exclusively for consumers' personal non-commercial use, and may not be used for any purpose other than to identify prospective properties for purchase. Use of this data provided by MLS GRID may be subject to an end user license agreement prescribed by CANOPY MLS if any and as amended from time to time. Listing provided courtesy of Triangle MLS, Inc. of NC, Internet Data Exchange Database.

It stands as a major financial center, housing the headquarters of national and international banks. Alongside finance, the healthcare, technology, and manufacturing sectors significantly contribute to the local economy. This diversity in industries has created a stable job market and attracts professionals from various fields. AARP provides a Livability Index Search Page where it scores communities and even neighborhoods across the country for services and amenities that impact your life. You can check your current city score or others where you might like to live near Charlotte. The livability index Community Finder tool allows you to filter by location, community size, livability measures, and other features, such as state and local plans to create age-friendly communities.

The average American household spent roughly $5,577 per month in 2021. Some 33% of that—or approximately $1,885—went toward housing costs. When it comes to politics, the Charlotte metro area showcases a mix of affiliations. While the city itself tends to lean towards Democratic candidates, the surrounding suburban areas are more conservative.

Because the price of goods and services varies from one city to the next, calculating the cost of living will determine how affordable it is to live in a certain area. The expenses that factor into cost of living can include housing affordability, transportation expenses, food prices and entertainment costs. Cost of living is also tied to income, as salary levels in a geographic area are measured against these expenses. A cost of living calculator helps you to assess how much you will need to make in order to live comfortably in a specific city. It takes into account various expenses that you will make in your daily lives (on housing, food, utilities, transportation, entertainment, etc.) and helps you determine a livable salary. The prices of goods and services vary in different cities, and hence having a cost of living index or calculator can make the decision to move easier by allowing you to directly compare one city with another.

This expense may be a mortgage or rent, and it is typically the single biggest expense for consumers. The 2021 Consumer Expenditure Survey published by the Bureau of Labor Statistics found that housing expenses accounted for 26 percent of average budgets, or about $22,624 annually. Depending on income level, some consumers spend significantly more than that.

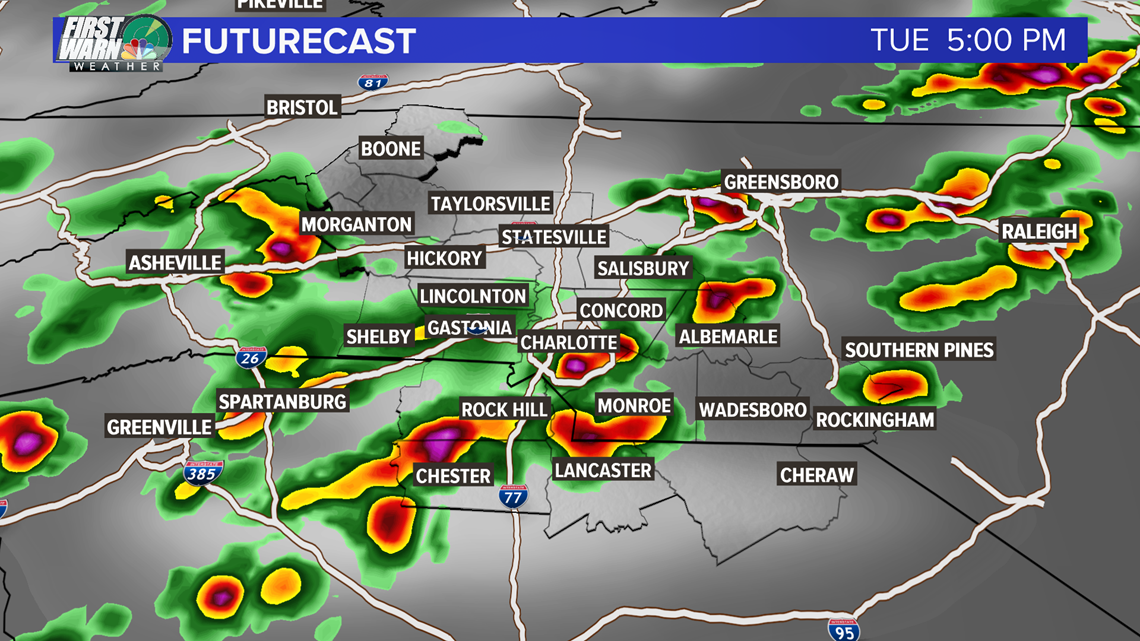

The bus system, known as CATS (Charlotte Area Transit System) comprises 70 different local, regional, and express routes. A local ride will cost you $2.20 each way, while express and regional tickets go for $3.00 and $4.40, respectively. For when you first touch down at Charlotte Douglas International Airport, Sprinter Bus Service can shuttle you to any of various central locations. Ride-sharing services like Uber and Lyft, taxis, and bike-sharing services like Charlotte B-cycle and LimeBike can also whisk you around the city.

Also, remember that some of the outputs on the cost of living calculator – like medical visits – are for a single person, so you’ll need to adjust the calculations if you’re married or have children. You may also need to scale up the food costs, depending on the size of your household. Lifestyle plays a significant role in cost of living expenses and includes the cost of items above and beyond necessities such as food and housing. This category of expenses could include clothing, entertainment and personal care such as haircuts and more. Now that you have a better sense of the pros and cons of living in Charlotte, NC, are you ready to make the move and start living your best life in the Queen City?